| • | “Corporate Change” means the first to occur of any of the following events: (1) any person acquires 50% or more of our common stock or voting securities, other than (a) any acquisition directly from or resulting from an acquisition of our shares by the Company, (b) any acquisition by any employee benefit plan (or related trust) sponsored or maintained by the Company or any entity controlled by the Company, or (c) any acquisition by any entity pursuant to a transaction which complies with clauses (a) or (b); (2) the occurrence of a merger, reorganization, consolidation or disposition of all or substantially all of our assets, unless our shareholders prior to such transaction hold more than 50% of the equity and voting power of the resulting entity or entity holding such assets, no person (other than benefit plans of such entity) holds 50% or more of the equity or voting power of such entity and at least a majority of the board of directors of such entity were members of the Incumbent Board; (3) our shareholders approve our complete liquidation or dissolution; or (4) under the Kenningham Incentive Agreement, within any period of 24 consecutive months and subject to certain exceptions, a change in the composition of the board of directors of the Company such that the incumbent board ceases for any reason to constitute a least a majority of the Board.“Constructive Termination Event” shall occur upon: (1) the failure by us to pay the executive’s compensation as provided in the applicable agreement; (2) relocation without his consent of his primary employment location of more than 50 miles; (3) our request that the executive perform any illegal activity or sign-off on any inappropriate financial statement or acknowledgement; (4) a material diminution in the executive’s position, duties, responsibilities, reporting status, or authority; or (5) a material negative reduction in base salary or incentive compensation targets within six months after a Corporate Change, except that before exercising his right to terminate the employment relationship pursuant to any of the previous provisions, he must first give written notice to our Board of the circumstances purportedly giving rise to his right to terminate and must provide us with a minimum of thirty days (fifteen days under the Incentive Agreement) to correct the problem, unless correction is inherently impossible.

“Disability” under the Employment Agreement and Retention Agreement shall mean the executive’s becoming incapacitated by accident, sickness or other circumstance that in the reasonable opinion of a qualified doctor approved by our Board, renders him mentally or physically incapable of performing the essential functions of the executive’s position, with or without reasonable accommodation, and that will continue, in the reasonable opinion of the doctor, for a period of no less than 180 days.

“Disability” under the Incentive Agreement means any ailment or condition that prevents the executive from actively carrying out his duties under the Incentive Agreement for a continuous period of 120 days.

| | |  | “Constructive Termination Event” occurs upon: (1) the failure by us to pay the executive’s compensation as provided in the applicable agreement; (2) relocation without his consent of his primary employment location of more than 50 miles; (3) our request that the executive perform any illegal activity or sign-off on any inappropriate financial statement or acknowledgement; (4) a material diminution in the executive’s position, duties, responsibilities, reporting status, or authority; or (5) a material negative reduction in base salary or incentive compensation targets within six months after a Corporate Change, except that before exercising his right to terminate the employment relationship pursuant to any of the previous provisions, he must first give written notice to our Board of the circumstances purportedly giving rise to his right to terminate and must provide us with a minimum of thirty days (fifteen days under the Kenningham Incentive Agreement) to correct the problem, unless correction is inherently impossible. | | • | Proxy Statement 2022 | 58“Disability” under the McHenry Retention Agreement means the executive’s becoming incapacitated by accident, sickness, or other circumstance that, in the reasonable opinion of a qualified doctor approved by our Board, renders him mentally or physically incapable of performing the essential functions of the executive’s position, with or without reasonable accommodation, and that will continue, in the reasonable opinion of the doctor, for a period of no less than 180 days. | | • | “Disability” under the Kenningham Incentive Agreement means any ailment or condition that prevents the executive from actively carrying out his duties under the Kenningham Incentive Agreement for a continuous period of 120 days. | | • | “Involuntary Termination” means, for purposes of the McHenry Retention Agreement, a termination by the executive due to a Constructive Termination Event by itself or in relation to a Corporate Change, or by us for any reason without Cause, at the discretion of our Board; an “Involuntary Termination” also includes the nonrenewal of the executive’s employment agreement by the Board. Under the Kenningham Incentive Agreement, an Involuntary Termination has the meaning described above. | | • | “Voluntary Termination” means a termination by the executive other than for a Constructive Termination Event. |

Proxy Statement 2022 | 59

“Involuntary Termination” shall mean, for purposes of the Employment Agreement and Retention Agreement, a termination by the executive due to a Constructive Termination Event by itself or in relation to a Corporate Change, or by us for any reason without Cause, at the discretion of our Board; an “Involuntary Termination” also includes the nonrenewal of the executive’s employment agreement by the Board. Under the Incentive Agreement, an Involuntary Termination has the meaning defined in the description of such agreement above.

“Voluntary Termination” shall mean a termination by the executive other than for a Constructive Termination Event.

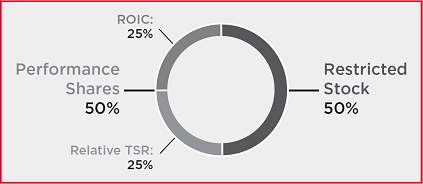

Group 1 Automotive 2014 Long Term Incentive PlanUpon the occurrence of a Corporate Change, the CHR Committee, in its sole discretion, may decide to accelerate and fully vest any restricted stock awards then outstanding, and, upon such vesting, all restrictions applicable to the restricted stock will terminate. Further, the CHR Committee may determine that the performance conditions are satisfied for the performance share awards upon a Corporate Change if the participant is also terminated without cause or for good reason in connection with the Corporate Change, or the participant’s award is not assumed or converted by the controlling entity following the Corporate Change. A Corporate Change occurs if (1) we are dissolved and liquidated; (2) we are not the surviving entity in any merger or consolidation (or we survive only as a subsidiary of an entity); (3) we sell, lease or exchange all or substantially all of our assets to any other person or entity; (4) any person, entity or group acquires or gains ownership or control of more than 50% of the outstanding shares of our voting stock; or (5) after a contested election of directors, the persons who were directors before such election cease to constitute a majority of our Board of Directors. GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 70 Our named executive officersNEOs do not currently, and atas of December 31, 20212023 did not, hold any unvested stock options, and therefore there are no amounts to report with respect to acceleration of stock option awards by the CHR Committee in connection with a Corporate Change.report. The restricted stock award agreements for restricted stock also establish vesting provisions applicable to termination of employment. TheSuch award agreement for all grants of restricted stock to our named executive officers, providesagreements provide for accelerated vesting if the named executive officer’sNEO’s employment is terminated due to death or disability. The award agreements also provide for accelerated vesting in the case of death or disability during the two-year period following a qualified retirement. A “qualified retirement” with respect to the 20212022 and 2023 awards generally means a retirement after attaining the age of 63 and following the date on which the sum of the executive’s age and years of service equals or exceeds the age of 70, and so long as the executive has completed, in aggregate, five years of service, and upon satisfaction of a two year two-year non-compete and certain non-disclosure covenants. A “qualified retirement” with respect to awards granted prior to 20212022 generally means a termination of employment on a date that is on or after the employee’s attainment of age 63 and following the employee’s completion of at least ten years of service with the Company and upon satisfaction of a two year two-year non-compete and certain non-disclosure covenants. Additionally, awards granted during the year employment is terminated will vest, provided the executive received such an award at least six months prior to termination. The performance share agreements for our named executive officers providesNEOs provide that upon a named executive’s officer’sNEO’s termination due to death or disability, the performance shares will paybe paid out following the performance period based on actual performance. If a named executive officer’sNEO’s employment is terminated due to a “planned retirement” (generally defined as a mutually agreed upon retirement by the officer and the Company), the performance shares will convert to time-based restricted stock awards that will continue to vest, subject to the officer’s compliance with applicable restrictive covenants, until the second anniversary of the named executive officer’sNEO’s termination of employment. Such a conversion will occur based on the actual performance achieved during the performance period. All other terminations of employment (other than as described above in connection with a Corporate Change) will result in a forfeiture of the performance shares without payment. As described in the CD&A above, the 20212022 and 2023 performance shares were also granted with a Maximum Value limitation. For performance share awards granted prior to 2021,2022, a similar maximum value limitationMaximum Value Limitation applied, but that limitation applied to both TSRrTSR and ROIC-based awards, to be calculated separately. These value limits could potentially alter the number of shares that become payable in connection with an acceleration or payment event.

Non-Competition Agreements Non-Competition Agreements

Along with their respective employment agreements, Mr. Hesterberg has entered into a Non-Compete Agreement and Messrs. Kenningham and McHenry have entered into an Incentive Compensationincentive compensation and Non-Compete Agreementnon-compete agreement with the Company, each of which provideprovides that for a period of two years following the executive’s termination of employment, the executive will not compete with the Company or induce any of our employees to leave his or her employment with us or hire any of our employees. If Mr. Hesterberg violates this agreement, he will also forfeit his rights to any restricted stock and stock options granted pursuant to his employment agreement, and we will have the right to refrain from making any further payments under that agreement, as well as to receive back from Mr. Hesterberg the full value of any payments which were made to him in the previous twelve months as well as the value of any restricted stock or stock options that may have vested during the past twelve months from the date of Mr. Hesterberg’s termination. If Mr. McHenry violates his agreement, we will have the right to demand forfeiture of any cash or equity award realized during the twelve months prior to the violation. If Mr. Kenningham violates his agreement, we will have the right to refrain from making any further payments under histhe Kenningham Incentive Agreement.

Messrs. Hesterberg and Grese are eligible for a “qualified retirement”, as previously described under “2021 Compensation Discussion and Analysis — Long Term Equity Incentive Compensation,” and therefore would be subject to the two year non-compete agreement described therein.

Messrs. Kenningham, McHenry and DeLongchamps were not eligible for a qualified retirement as of December 31, 2021.2023. TERMINATION AND CHANGE IN CONTROL TABLES FOR 2021

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 71 Termination and Change in Control Tables for 2023The following tables present for each named executive officer,below disclose the estimated payments andamount of compensation and/or other benefits that would have been payable as ofdue to the end of 2021NEOs in the event of atheir termination of employment, andincluding but not limited to, in connection with a Corporate Change, as narratively described above. These estimated amounts have been calculated as ifassuming the individual’s employment had been terminated, or a Corporate Change hadtermination occurred as ofon December 31, 2021, the last business day of 2021,2023, and using athe Company common stock closing price of the Company’s common stock$304.74 on December 31, 2021 which was $195.22. 29, 2023 (the last trading day of the 2023 year).

The equity award calculations in the tabletables below do not include performance shares becausefor which the performance period has not been fulfilled. For additional information regarding the possible payouts for performance shares, see “Grants of Plan-Based Awards” above. | | | | | | | | | | | | | | | | | | | | | | | Earl J. Hesterberg | | Involuntary

Termination

($) | | | Constructive

Termination

($) | | | Corporate

Change1

($) | | | Death and

Disability

($) | | | | | | | Salary and Bonus | | | 3,720,000 | | | | 3,720,000 | | | | 5,580,000 | | | | 2,480,000 | | | | | | | Equity Compensation2 | | | 18,977,141 | | | | 18,977,141 | | | | 18,977,141 | | | | 18,977,141 | | | | | | | Use of Vehicle | | | 17,574 | | | | 17,574 | | | | 17,574 | | | | 35,148 | | | | | | | TOTAL | | | 22,714,715 | | | | 22,714,715 | | | | 24,574,715 | | | | 21,492,289 | | | | | | | | | | | | | | | | | | | | | | | | | Daryl A. Kenningham | | Involuntary

Termination

($) | | | Constructive

Termination

($) | | | Corporate

Change1

($) | | | Death and

Disability

($) | | | | | | | Salary and Bonus | | | 1,881,000 | | | | 1,881,000 | | | | 1,881,000 | | | | — | | | | | | | Equity Compensation | | | 7,694,206 | | | | 7,694,206 | | | | 7,694,206 | | | | 7,694,206 | | | | | | | TOTAL | | | 9,575,206 | | | | 9,575,206 | | | | 9,575,206 | | | | 7,694,206 | | | | | | | | | | | | | | | | | | | | | | | | | Daniel McHenry | | Involuntary

Termination

($) | | | Constructive

Termination

($) | | | Corporate

Change1

($) | | | Death and

Disability

($) | | | | | | | Salary and Bonus | | | 475,159 | 3 | | | — | | | | — | | | | 475,159 | | | | | | | Equity Compensation | | | — | | | | — | | | | 2,315,504 | | | | 2,315,504 | | | | | | | TOTAL | | | 475,159 | | | | — | | | | 2,315,504 | | | | 2,790,663 | |

| | |  | | Proxy Statement 2022 | 60 |

Proxy Statement 2022 | 61

| | | | | Frank Grese, Jr. | | Involuntary

Termination

($) | | | Constructive

Termination

($) | | | Corporate

Change1

($) | | | Death and

Disability

($) | | | | Equity Compensation2 | | | — | | | | — | | | | 3,711,913 | | | | 3,711,913 | | | | | Daryl A. Kenningham | | | Involuntary

Termination

($) | | Constructive

Termination

($) | | Corporate

Change(1)

($) | | Death and

Disability

($) | | Salary and Bonus | | | 2,949,705 | | 2,949,705 | | 2,949,705 | | — (3) | | Equity Compensation | | | 12,725,334 | | 12,725,334 | | 12,725,334 | | 12,725,334 | TOTAL | | | — | | | | — | | | | 3,711,913 | | | | 3,711,913 | | | 15,675,039 | | 15,675,039 | | 15,675,039 | | 12,725,334 | | | | | | | | | | | | | | | | | | | Daniel J. McHenry(2) | | | Involuntary

Termination

($) | | Constructive

Termination

($) | | Corporate

Change(1)

($) | | Death and

Disability

($) | | Salary and Bonus | | | 660,000 | | — | | — | | 660,000 | | Equity Compensation | | | — | | — | | 3,659,623 | | 3,659,623 | | TOTAL | | | 660,000 | | — | | 3,659,623 | | 4,319,623 | | | | | | | | | | | | Peter C. DeLongchamps | | Involuntary

Termination

($) | | | Constructive

Termination

($) | | | Corporate

Change1

($) | | | Death and

Disability

($) | | | Involuntary

Termination

($) | | Constructive

Termination

($) | | Corporate

Change(1)

($) | | Death and

Disability

($) | | Equity Compensation | | | — | | — | | 4,045,424 | | 4,045,424 | | TOTAL | | | — | | — | | 4,045,424 | | 4,045,424 | | | | | | | | | | | | Gillian A. Hobson | | | Involuntary

Termination

($) | | Constructive

Termination

($) | | Corporate

Change(1)

($) | | Death and

Disability

($) | | Salary and Bonus | | | — | | — | | — | | — | Equity Compensation | | | — | | | | — | | | | 3,752,324 | | | | 3,752,324 | | | — | | — | | 463,205 | | 463,205 | | TOTAL | | | — | | — | | 463,205 | | 463,205 | | | | | | | | | | | | Michael D. Jones | | | Involuntary

Termination

($) | | Constructive

Termination

($) | | Corporate

Change(1)

($) | | Death and

Disability

($) | | Salary and Bonus | | | — | | — | | — | | — | | Equity Compensation | | | — | | — | | 3,590,752 | | 3,590,752 | TOTAL | | | — | | | | — | | | | 3,752,324 | | | | 3,752,324 | | | — | | — | | 3,590,752 | | 3,590,752 |

1(1) | For Messrs. Hesterberg andMr. Kenningham, the amounts in this column reflect the cash payments and acceleration value of equity award benefits that would become payable upon a qualifying termination following a Corporate Change. Upon a Corporate Change without an accompanying qualifying termination, Messrs. Hesterberg andMr. Kenningham, along with the remaining named executive officers,NEOs, would also be eligible to receive accelerated vesting of outstanding equity awards in connection with a Corporate Change only upon the sole discretion of the CHR Committee, which we have assumed to have occurred for purposes of this table. |

2(2) | Although Messrs. Hesterberg and Grese have attained the age for a qualified retirement, each executive would be eligible to receive unvested restricted stock only if he remained compliant with his restrictive covenants.

|

3 | For Mr. McHenry, this amountamounts only relatesrelate to a termination by the Company without Cause, or due to death or Disability. | | (3) | Mr. Kenningham could receive up to 120 days of continued base salary ($361,644) in the event of Death and Disability.that he is deemed to incur a disability. |

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 72

Director Compensation

2021 DIRECTOR COMPENSATION TABLE

The following table sets forth a summary of the compensation we paid to our non-employee directors in 2021. Directors who are our full-time employees, currently Messrs. Hesterberg and Pereira, receive no compensation for serving as directors. Mr. Hesterberg’s compensation is shown in the Summary Compensation Table and related tables above and Mr. Pereira’s compensation is discussed in the section titled “Certain Relationships and Related Transactions.”

| | | | | | | | | | | | | | | | | | | | | | | | | | | | Name | | Fees Earned

or Paid in

Cash1

($) | | | Stock

Awards2,3

($) | | | All Other

Compensation4

($) | | | Change in

Pension Value

and Nonqualified

Deferred

Compensation

Earnings5

($) | | | Total

($) | | | | | | | | Carin M. Barth | | | 70,021 | | | | 199,979 | | | | 20,000 | | | | 11 | | | | 290,011 | | | | | | | | Steven C. Mizell6 | | | 37,698 | | | | 167,598 | | | | 16,722 | | | | — | | | | 222,018 | | | | | | | | Stephen D. Quinn | | | 158,771 | | | | 199,979 | | | | 20,000 | | | | — | | | | 378,750 | | | | | | | | Steven P. Stanbrook | | | 45,021 | | | | 199,979 | | | | 20,000 | | | | — | | | | 265,000 | | | | | | | | Charles L. Szews | | | 60,021 | | | | 199,979 | | | | 20,000 | | | | — | | | | 280,000 | | | | | | | | Max P. Watson, Jr.7 | | | 22,521 | | | | 199,979 | | | | 10,000 | | | | — | | | | 232,500 | | | | | | | | Anne Taylor | | | 60,021 | | | | 199,979 | | | | 20,000 | | | | 1,794 | | | | 281,794 | | | | | | | | MaryAnn Wright | | | 51,271 | | | | 199,979 | | | | 20,000 | | | | 20 | | | | 271,270 | |

1 | The amounts in this column include the cash value of a fractional share awarded as part of the equity-based compensation retainer as described in more detail in the narrative.

|

2 | The amounts included in the “Stock Awards” column represent the grant date fair value of awards computed in accordance with FASB ASC Topic 718. Assumptions made in the calculation of these amounts are included in Note 5 to our audited financial statements for the fiscal year ended December 31, 2021, included in our Annual Report on Form 10-K.

|

3 | Our directors are offered the option of taking their annual retainer in restricted stock or restricted stock units. In 2021 each non-employee director received 1,576 shares of restricted stock or restricted stock units in payment of the equity portion of the 2021 annual retainer. Mr. Mizell joined the Board March 1, 2021, and received a prorated retainer of 1,069 shares for 2021.

|

4 | The amounts in this column reflect the annual vehicle stipend.

|

5 | Amounts reported reflect above-market earnings on the Deferred Compensation Plan. Amounts are reflective of earnings in excess of 120% of the applicable federal long-term rate, with compounding, of 1.56%. We do not sponsor a pension plan.

|

6 | Mr. Mizell was appointed to the Board on March 1, 2021.

|

7 | Mr. Watson retired from the Board effective May 12, 2021.

|

| | |  | | Proxy Statement 2022 | 62 |

Proxy Statement 2022 | 63

RETAINERS AND FEES

The table below sets forth the compensation components we paid to our non-employee directors which governed the 2021 compensation program:

| | | | | | | Retainer and Meeting Fees1

| | 2021

($) | | | | Annual Retainer

| | | | | | | Annual Cash Retainer

| | | 45,000 | | | | Equity Retainer2

| | | 200,000 | | | | Additional Annual Retainers

| | | | | | | Non-Executive Chair of the Board3

| | | 100,000 | | | | Audit Committee Chair

| | | 25,000 | | | | Compensation & Human Resources Committee Chair

| | | 15,000 | | | | Finance/Risk Management Committee Chair

| | | 15,000 | | | | Governance & Corporate Responsibility Committee Chair4

| | | 10,000 | | | | Annual Vehicle Stipend

| | | 20,000 | |

2 | The equity portion of the retainer is paid annually in restricted stock or restricted stock units valued at approximately $200,000 at the time of the grant pursuant to the 2014 Long Term Incentive Plan.

|

3 | The annual retainer for the Non-Executive Chair of the Board was increased to $135,000, effective November 16, 2021.

|

4 | The annual retainer for the GCR Committee Chair was increased to $15,000, effective November 16, 2021.

|

EQUITY-BASED COMPENSATION

The equity portion of our non-employee directors’ retainers is paid annually in restricted stock or restricted stock units valued at approximately $200,000 at the time of the grant pursuant to the 2014 Long Term Incentive Plan. In 2021, directors could elect whether to receive the equity retainer in restricted stock or restricted stock units. In 2021, all of our then current directors elected to receive their annual retainer in restricted stock, except for Ms. Barth, Mr. Mizell, Ms. Taylor and Ms. Wright, who each elected to receive restricted stock units. The grant was effective January 4, 2021 and was determined based on the average of the high and low market price of our common stock on that date. Accordingly, each non-employee director received 1,576 shares of restricted stock or restricted stock units in payment of the equity portion of the 2021 annual retainer. Mr. Mizell was elected to the Board on March 1, 2021. Upon his election, he received a pro rata annual retainer of 1,069 shares of restricted stock units.

Restricted stock or restricted stock units granted to our directors vest immediately upon issuance. All vested awards held by a director will settle upon the retirement, death or disability of the director. Under grants of restricted stock units made prior to 2019, the vested restricted stock units held by a director are settled or shares of our common stock upon the termination of the director’s membership on our Board of Directors. Beginning with grants of restricted stock units made following January 1, 2019, all restricted stock units are settled in cash.

STOCK OWNERSHIP GUIDELINES

Our Board has adopted Stock Ownership Guidelines that apply to our non-employee directors. In November 2021, following discussion with PM&P, upon the recommendation of the GCR Committee, the Board approved updates to the Stock Ownership Guidelines. Under the updated Stock Ownership Guidelines, our non-employee directors are required to maintain stock ownership value of $450,000 (“Director Ownership Requirement”) within five years. Once the Director Ownership Requirement is achieved, directors may sell or otherwise dispose of any shares in excess of the $450,000 value. In the event a director’s stock ownership value falls below the Director Ownership Requirement because of a decline in stock price, the director is prohibited from selling or otherwise disposing of shares of the Company’s common stock until the Director Ownership Requirement is reestablished through open

market purchases or annual director equity grants. Restricted stock granted to directors as part of the annual retainer counts toward the Director Ownership Requirement without regard to the vesting or other liquidity provisions related thereto. Stock that applies toward satisfaction of these guidelines includes: (1) shares of common stock owned outright by the director and his or her immediate family members who share the same household, whether held individually or jointly and (2) awarded restricted stock and restricted stock unit shares. Each of our directors has met, or will meet within the applicable timeframe, our current Director Ownership Requirements.

NONQUALIFIED DEFERRED COMPENSATION

In November 2020, the CHR Committee approved an amendment and restatement to the Deferred Compensation Plan, effective January 1, 2021. Under the amended and restated plan, non-employee directors can no longer defer director compensation under the plan. However, previously deferred amounts remain deferred under the plan until the originally scheduled payment date. Please see the section entitled “Executive Compensation — Nonqualified Deferred Compensation” for a more fulsome description of the Company’s Deferred Compensation Plan and the material changes approved under the amended and restated plan.

Prior to amending the Deferred Compensation Plan effective January 1, 2021, the plan provided those directors who elected to participate an opportunity to accumulate additional savings for retirement on a tax-deferred basis. The non-employee directors could defer any portion of the cash compensation (annual retainer or meeting fees) that he or she received with respect to the services provided to our Board, including any committee services, and the director would be 100% vested in his account at all times. We have complete discretion over how the deferred funds are utilized and they represent our unsecured obligation to the participants.

COMPENSATION CHANGES FOR FISCAL 2022

As described above, in November 2021, following review of a competitive market analysis prepared by PM&P, the GCR Committee recommended an increase in the annual retainers paid to the Non-Executive Chair of the Board and the GCR Committee Chair. Accordingly, the Board approved an increase in the annual retainer for the Non-Executive Chair of the Board from $100,000 to $135,000 and for the GCR Committee Chair from $10,000 to $15,000. The increases to the annual retainers were approved in order to maintain market competitiveness.

| | |  | | Proxy Statement 2022 | 64 |

Proxy Statement 2022 | 65

CEO Pay Ratio Disclosure

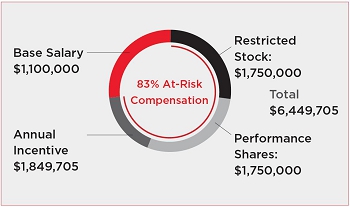

SEC regulations require that we provide a comparison of the annual total compensation of our Chief Executive OfficerCEO in 2021,2023, to the annual total compensation of an individual identified as our median compensated employee. For 2021, our last completed fiscal year: Mr. Hesterberg’s annual total compensation was $8,577,257

Identifying the Median Employee Our median employee’s total compensation was $54,880

COMPENSATION MEASURE The ratio of Mr. Hesterberg’s annual total compensation to our median employee’s annual total compensation was 156 to 1.

SEC rules allow us to use the employee identified in 2020 for three years. However, this individual was on leave for a substantial part of 2021. Therefore, for 2021 we selected an employee with substantially similar compensation to the 2020 identified median employee.

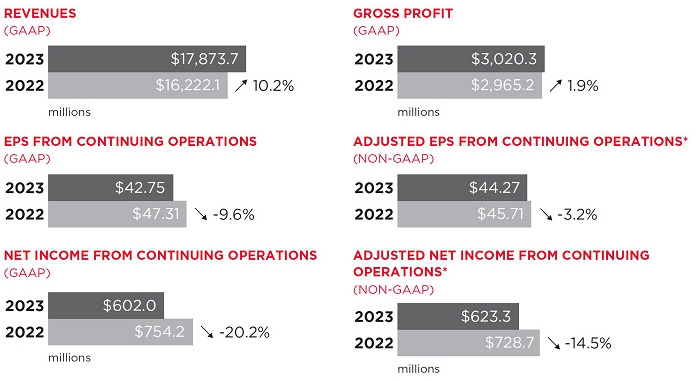

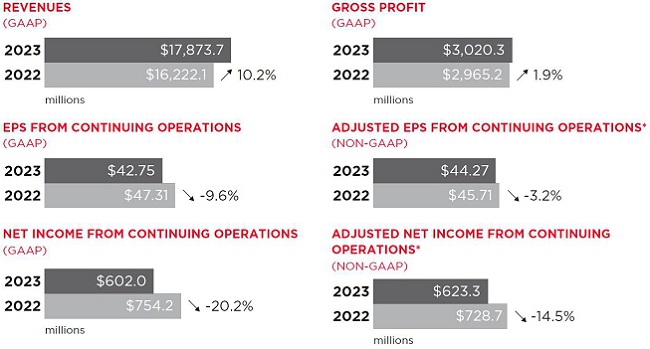

We identified our 20202023 median compensated employee based on our population as of December 31, 2020.2023. We used a consistently applied compensation measure which included total gross wages using our payroll records for fiscal 2020.2023. We converted the amount of compensation paid to non-U.S. employees to U.S. dollars using average foreign currency exchange rates for 2020.2023. We annualized compensation for employees hired during 2020.2023. EMPLOYEES INCLUDED AND EXCLUDEDSEC rules allow us to use the employee identified in 2021 for three years. Because there has not been a material change in our employee population or employee compensation arrangements since 2021 that would result in a significant change in the CEO Pay Ratio, we are using the same employee in 2023 as we did in 2022 and 2021, as permitted by SEC rules. Calculating the RatioMETHODOLOGYAnnual 20212023 total compensation for the identified median employee and our CEO was calculated according to the SEC rules used to calculate the “Total” column in the Summary Compensation Table. We believe the pay ratio information set forth aboveherein constitutes a reasonable estimate, calculated in a manner consistent with applicable SEC regulations. RESULTSFor 2023, our last completed fiscal year: | • | Mr. Kenningham’s annual total compensation was $7,274,300 | | • | Our median employee’s total compensation was $58,547 | | • | The ratio of Mr. Kenningham’s annual total compensation to our median employee’s annual total compensation was 124 to 1. |

Comparing GP1’s Ratio to Other CompaniesBecause other companies may use different methodologies to identify their median employees, the pay ratio set forth above may not be comparable to the pay ratios used by other companies.

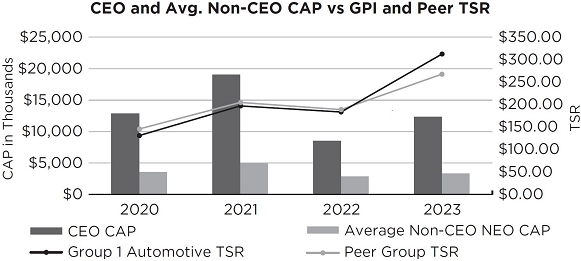

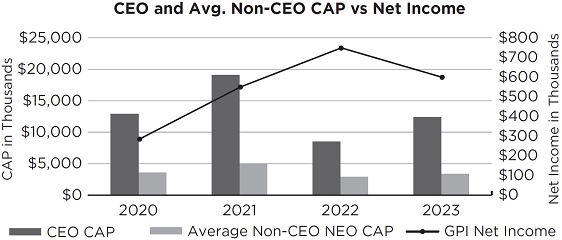

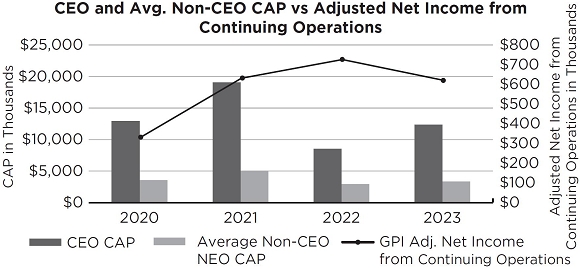

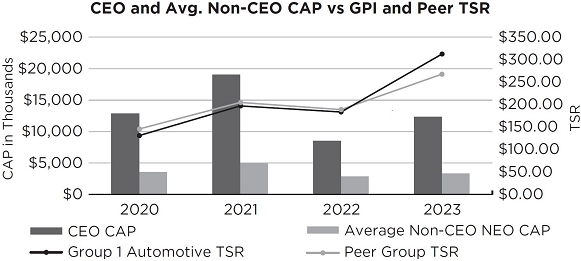

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 73 Pay Versus Performance DisclosureIn accordance with SEC rules, we provide the following disclosure regarding executive “compensation actually paid” (“CAP”) and certain Company performance for the fiscal years listed below. Please refer to the CD&A for a complete description of how executive compensation relates to Company performance and how the CHR Committee makes its decisions. | | | | | | | | | | | | | | | Average

Summary | | | Average | | | Value of Initial Fixed $100

Investment Based On: | | | | | | Adjusted | | | Year | | Summary

Compensation

Table Total for

Kenningham(1) | | | Compensation

Actually Paid to

Kenningham(1) (2) (3) | | | Summary

Compensation

Table Total for

Hesterberg(1) | | | Compensation

Actually Paid to

Hesterberg(1) (2) (3) | | | Compensation

Table Total

for Non-CEO

NEOs(4) | | | Compensation

Actually Paid

to Non-CEO

NEOs(2) (3) (4) | | | Total

Shareholder

Return | | | Peer Group

Total

Shareholder

Return(5) | | | Net

Income

(in

millions) | | | Net Income

from

Continuing

Operations | | | (a) | | | (b) | | | | (c) | | | | (b) | | | | (c) | | | | (d) | | | | (e) | | | | (f) | | | | (g) | | | | (h) | | | | (i) | | | 2023 | | $ | 7,274,300 | | | $ | 12,370,687 | | | | N/A | | | | N/A | | | $ | 2,053,869 | | | $ | 3,343,276 | | | $ | 313.79 | | | $ | 268.90 | | | $ | 601.6 | | | $ | 623.3 | | | 2022 | | | N/A | | | | N/A | | | $ | 8,774,685 | | | $ | 8,512,251 | | | $ | 2,881,512 | | | $ | 2,877,697 | | | $ | 184.39 | | | $ | 189.75 | | | $ | 751.5 | | | $ | 728.7 | | | 2021 | | | N/A | | | | N/A | | | $ | 8,577,257 | | | $ | 19,080,981 | | | $ | 2,684,236 | | | $ | 4,992,687 | | | $ | 197.96 | | | $ | 205.74 | | | $ | 552.1 | | | $ | 633.7 | | | 2020 | | | N/A | | | | N/A | | | $ | 7,298,579 | | | $ | 12,911,445 | | | $ | 2,657,309 | | | $ | 3,543,096 | | | $ | 131.93 | | | $ | 146.68 | | | $ | 286.5 | | | $ | 333.0 | |

| | | (1) | Earl Hesterberg served as CEO until 12/31/2022. Effective 1/1/2023, Daryl Kenningham was named CEO. | | (2) | Deductions from, and additions to, total compensation in the 2023 Summary Compensation Table to calculate Compensation Actually Paid consist of: |

| (3) | Equity valuation assumptions for calculating Compensation Actually Paid are not materially different from grant date valuation assumptions. | | (4) | Non-CEO NEOs reflect the average Summary Compensation Table total compensation and average Compensation Actually Paid for the following executives by year: 2023: Daniel J. McHenry, Peter C. DeLongchamps, Gillian A. Hobson, Michael D. Jones 2022: Daryl A. Kenningham, Daniel J. McHenry, Peter C. DeLongchamps, Darryl Burman 2021: Daryl A. Kenningham, Daniel J. McHenry, Frank Grese Jr., Peter C. DeLongchamps 2020: Daryl A. Kenningham, Daniel J. McHenry, John Rickel, Frank Grese Jr., Peter C. DeLongchamps |

| (5) | The peer group is comprised of Lithia Motors, Autonation, Sonic Automotive, Penske Automotive Group, and Asbury Automotive Group | | (6) | Reconciliations for Adjusted Net Income can be found on page 130 of this proxy statement |

| | | (1) | Earl Hesterberg served as CEO until 12/31/2022. Effective 1/1/2023, Daryl Kenningham was named CEO. |

| (2) | Deductions from, and additions to, total compensation in the 2023 Summary Compensation Table to calculate Compensation Actually Paid consist of: |

| | | 2023 | | | | | Daryl A.

Kenningham | | Average

Non-CEO

NEOs | | | Total Compensation from Summary Compensation | | $ | 7,274,300 | | $ | 2,053,869 | | | Adjustments for Pension | | | | | | | | | Adjustment for Summary Compensation Table Pension | | $ | 0 | | $ | 0 | | | Amount added for current year service cost | | $ | 0 | | $ | 0 | | | Amount added for prior service cost impacting current year | | $ | 0 | | $ | 0 | | | Total Adjustments for Pension | | $ | 0 | | $ | 0 | | | Adjustments for Equity Awards | | | | | | | | | Adjustment for grant date values in the Summary Compensation Table | | $ | (3,499,802) | | $ | (737,385) | | | Year-end fair value of unvested awards granted in the current year | | $ | 6,420,975 | | $ | 1,284,874 | | | Year-over-year difference of year-end fair values for unvested awards granted in prior years | | $ | 2,395,423 | | $ | 684,640 | | | Fair values at vest date for awards granted and vested in current year | | $ | 0 | | $ | 0 | | | Difference in fair values between prior year-end fair values and vest date fair values for awards granted in prior years | | $ | (298,389) | | $ | 38,931 | | | Forfeitures during current year equal to prior year-end fair value | | $ | 0 | | $ | 0 | | | Dividends or dividend equivalents not otherwise included in the total compensation | | $ | 78,180 | | $ | 18,348 | | | Total Adjustments for Equity Awards | | $ | 5,096,387 | | $ | 1,289,408 | | | Compensation Actually Paid (as calculated) | | $ | 12,370,687 | | $ | 3,343,276 | |

| (3) | Equity valuation assumptions for calculating Compensation Actually Paid are not materially different from grant date valuation assumptions. |

| (4) | Non-CEO NEOs reflect the average Summary Compensation Table total compensation and average Compensation Actually Paid for the following executives by year: |

2023: Daniel J. McHenry, Peter C. DeLongchamps, Gillian A. Hobson, Michael D. Jones 2022: Daryl A. Kenningham, Daniel J. McHenry, Peter C. DeLongchamps, Darryl Burman 2021: Daryl A. Kenningham, Daniel J. McHenry, Frank Grese Jr., Peter C. DeLongchamps 2020: Daryl A. Kenningham, Daniel J. McHenry, John Rickel, Frank Grese Jr., Peter C. DeLongchamps | (5) | The peer group is comprised of Lithia Motors, Autonation, Sonic Automotive, Penske Automotive Group, and Asbury Automotive Group | | (6) | Reconciliations for Adjusted Net Income can be found on page 130 of this proxy statement |

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 74TABULAR LIST OF FINANCIAL PERFORMANCE MEASURES

In our assessment, the most important financial performance measures used to link CAP (as calculated in accordance with the SEC rules), to our NEOs in 2023 to our performance were: | | | • | Adjusted Net Income, | | • | Relative Total Shareholder Return, and | | • | Return on Invested Capital. |

Certain RelationshipsPAY VERSUS PERFORMANCE: GRAPHICAL DESCRIPTION

The illustrations below provide a graphical description of CAP (as calculated in accordance with the SEC rules) and Relatedthe following measures: Transactions

| • | the Company’s cumulative TSR and the Peer Group’s cumulative TSR; | | • | the Company’s Net Income; and | | • | the Company Selected Measure, which is adjusted net income. |

CAP and Cumulative TSR / Cumulative TSR of the Peer Group

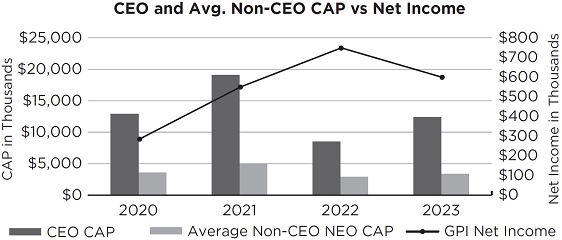

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 75 CAP and Company Net Income

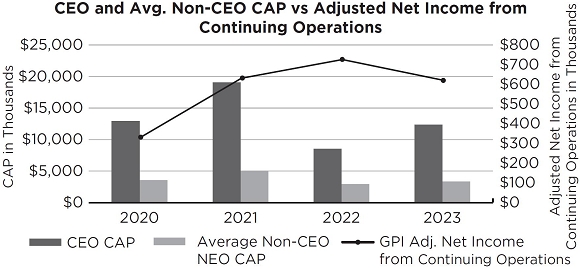

CAP and Adjusted Net Income from Continuing Operations

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 76 Audit Committee ReportTRANSACTIONS

During fiscal year 2021 we were not,The Audit Committee is appointed by the Board of Directors to assist the Board in fulfilling its oversight responsibilities relating to the integrity of the Company’s financial statements, the Company’s compliance with legal and we are not currently, a party to a transaction or seriesregulatory requirements, the independent registered public accounting firm’s qualifications, independence and performance, the performance of transactions in which the amount involved did or may exceed $120,000, in which anyCompany’s internal audit function, and the Company’s internal control over financial reporting. The Board of our directors, executive officers, any holderDirectors, upon the recommendation of more than 5% of our common stock or anyits Governance & Corporate Responsibility Committee, has determined that each member of the immediate familyAudit Committee has the requisite independence and other qualifications for audit committee membership under New York Stock Exchange corporate governance listing standards, the Sarbanes-Oxley Act of any of these persons had or will have a direct or indirect material interest, except as described below2002, the Audit Committee Charter and the compensation arrangements (including with respect to equity compensation) described in “2021 Compensation Discussion and Analysis,” “Executive Compensation” and “Director Compensation.”

Information below pertains to certain related party transactions related to the operations of our subsidiary UAB, which we acquired in February 2013. All of the operations of UAB are in Brazil. The conversion of amounts expressed in Brazilian Reais to U.S. Dollars was calculated by using the average currency exchange rate for 2021, as provided by Oanda. R$5.3950 = USD$1.00.

Lincoln Pereira and UAB

During 2021 we paid Lincoln Pereira, a Director of our Company, R$1,107,778.00 (USD$205,334.20) cash compensation for his services as our Regional Vice President, Brazil and as Chairman of our Brazilian subsidiary, UAB, and R$158,997.90 (USD$29,471.34) for health insurance.

Mr. Pereira’s brother, Ricardo Ribeiro da Cunha Pereira, serves as Honda’s General Manager. During 2021 the Company paid Mr. Ricardo Pereira R$706,650.55 (USD$130,982.49) in total compensation, consisting of R$648,497.61 (USD$120,203.45) of cash compensation and R$58,152.94 (USD$10,779.04) for health insurance.

Mr. Pereira’s brother, Andre Ribeiro, served as Commercial Operations Director until his death in May 2021. During 2021, the Company paid Mr. Ribeiro R$653,320.69 (USD$121,097.44) in total cash compensation, and R$228,290.92 (USD$42,315.28) for health insurance.

UAB leases office and retail space at market rates from Santorini Negócios Imobiliários Ltda. (“Santorini”), a real estate company which was co-founded by Mr. Pereira. The lease provides for monthly payments of R$180,000 (USD$33,364.23) and is adjusted annually pursuant to the IGP-M/FGV index. The lease expires in February 2029 but can be terminated with one-month prior notice, subject to a three month early-termination penalty payment. Current owners of Santorini include Mr. Pereira’s wife, Anna Luiza Flecha de Lima da Cunha Pereira, who also manages the property, Irene Maria Flecha de Lima, Mr. Pereira’s mother-in-law, and Andrea Maria Flecha da Lima, Mr. Pereira’s sister-in-law. Total payments to Santorini in 2021 are R$2,387,193.40 (USD$442,482.55). Mr. Pereira holds no ownership interest in Santorini.

UAB also leases office space at market rates from Irene Maria Flecha de Lima, Mr. Pereira’s mother-in-law, and managed by Anna Luiza Flecha de Lima da Cunha Pereira (Mr. Pereira’s wife) and Andrea Maria Flecha da Lima (Mr. Pereira’s sister-in-law). The lease provides for monthly payments of R$17,302.66 (USD$3,207.16) and is adjusted annually pursuant to the IGP-M/FGV index. The lease expired in October 2015 but can be terminated at any time with one-month prior notice. Total payments in 2021 are R$211,512.68 (USD$39,205.32).

Mr. Pereira’s cousin, Joao Candido Cunha Pereira, represents UAB in legal court cases solely relating to the State of Paraná. These legal services are governed by a contractual relationship signed in January 2012 for an undetermined term and can be terminated at any time with 90 days’ notice. All legal rates are at or below the current market rate for such legal services. Total payments to Joao Candido Cunha Pereira in 2021 are R$6,150 (USD$1,139.94). UAB previously was also represented in legal matters by Cunha Pereira Law Firm, which was controlled by Mr. Pereira and his father. Mr. Pereira closed the Cunha Pereira Law Firm in 2016.Group 1 Automotive, Inc. Corporate Governance Guidelines.

| | |  | | Proxy Statement 2022 | 66 |

Proxy Statement 2022 | 67

POLICIES AND PROCEDURES

We review all relationships and transactions in which we and our directors and named executive officers or their immediate family members are participants to determine whether such persons have a direct or indirect material interest. Our General Counsel’s office is primarily responsible forEach year, the development and implementation of written procedures and controls to obtain information from the directors and named executive officers with respect to related person transactions and for subsequently determining, based on the facts and circumstances disclosed to them, whether we or a related person has a direct or indirect material interest in the transaction. Transactions that are determined to be directly or indirectly material to us or a related person are disclosed as required in documents, including our proxy statement, filed with the SEC.

Our Code of Conduct discourages all conflicts of interest, requires disclosure and provides guidance on handling conflicts of interest. Under the Code of Conduct, conflicts of interest occur when private or family interests interfere in any way, or even appear to interfere, with the interests of our Company. Our restrictions on conflicts of interest under the Code of Conduct include related person transactions.

We have multiple processes for reporting conflicts of interests, and related person transactions. Under the Code of Conduct, all employees are required to report any actual or apparent conflict of interest, or potential conflict of interest, to their supervisors and all related person transactions involving our regional or market executives must be communicated in writing as part of their quarterly representation letter. This information is then reviewed by our Internal Audit Department, General Counsel, Audit Committee our Board or ourreviews the work and status of its independent registered public accounting firm as deemed necessary,with the Company. Deloitte also provides non-audit services, including, among others, tax planning and consultation and tax compliance.

The Audit Committee acts under a written charter adopted and approved by the Board of Directors. The Audit Committee reviews and reassesses the adequacy of the charter on an annual basis. The Audit Committee charter is posted on our website, www.group1corp.com, and you may obtain a printed copy of the Audit Committee charter by sending a written request to Group 1 Automotive, Inc., 800 Gessner Rd., Suite 500, Houston, TX 77024, Attn: Corporate Secretary. The Audit Committee assists the Board’s oversight and monitoring of the Company’s system of internal controls, including the internal audit function. The Audit Committee discussed with management. As part of this review,our internal auditors the following factors are generally considered: overall scope and plans for the nature2023 internal audit. At each Audit Committee meeting, the Audit Committee is provided the opportunity to meet with the internal auditor with, and without, management present. During 2023, management made updates to its internal control documentation for changes in internal control and completed its testing and evaluation of the related person’s interestCompany’s system of internal control over financial reporting in response to the transaction; the material termsrequirements set forth in Section 404 of the transaction, including, without limitation, the amountSarbanes-Oxley Act of 2002 and type of transaction;

the importancerelated regulations. The Audit Committee has kept apprised of the transaction to the related person;

the importanceprogress of the transactionevaluation and provided oversight and advice to a third party;

management during the importance ofprocess. In connection with this oversight, the transaction to us; whether the transaction would impair the judgment of a director, named executive officer or employee to act in the best interest of our Company;

whether the transaction might affect the status of a director as independent under the independence standards of the NYSE; and

any other matters deemed appropriate with respect to the particular transaction.

Ultimately, all such transactions must be approved or ratified by our Board. Any member of our Board who is a related person with respect to a transaction is recused from the review of the transaction.

In addition, our legal staff annually distributes a questionnaire to our named executive officers and members of our Board requesting certain information regarding, among other things, their immediate family members, employment and beneficial ownership interests. This information is then reviewed for any conflicts of interest under the Code of Conduct. At the completion of the annual audit, our Audit Committee received updates provided by management and the independent registered public accounting firm reviewat each regularly scheduled Audit Committee meeting and met in executive session separately with management, insider and related person transactions and potential conflictsthe director of interest. In addition, our internal audit function has processes in place, under its written procedure policies,and the independent registered public accounting firm to identify related person transactionsdiscuss the results of their examinations, observations and potential conflicts of interest and report themrecommendations regarding internal control over financial reporting.

The independent registered public accounting firm is accountable to senior managementthe Audit Committee, and the Audit Committee. We also have other policiesCommittee has the ultimate authority and proceduresresponsibility to prevent conflicts of interest. For example, our Corporate Governance Guidelines require that our Board assessselect, evaluate and, where appropriate, replace the independenceindependent registered public accounting firm. The Audit Committee engages in an annual evaluation of the non-management directors at least annually, including a requirement that it determine whether or not any such directors have a material relationshipindependent registered public accounting firm’s qualifications, assessing the firm’s quality of service, the firm’s sufficiency of resources, the quality of the communication and interaction with us, either directly or indirectly,the firm, and the firm’s independence. The Audit Committee makes its selection based on the best interests of the Company and its shareholders. The Audit Committee participates in the selection of the Lead Audit Partner (the “Lead Partner”) of the independent registered public accounting firm through its review of the Lead Partner’s professional qualifications, experience, and prior performance on the Company’s audit (if any), through in-person meetings with the Lead Partner, and through discussion between the Audit Committee and management regarding the selection of the Lead Partner.

The Audit Committee has reviewed and discussed with management and Deloitte, our audited financial statements as defined thereinof and as further described under “Information about ourfor the year ended December 31, 2023. The Audit Committee also discussed with Deloitte the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC. GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 77 Deloitte submitted to the Audit Committee the written disclosures and the letter required by the applicable requirements of the Public Company Accounting Oversight Board regarding the firm’s communications with the Audit Committee concerning its Committees —independence. The Audit Committee discussed with Deloitte such firm’s independence. The Audit Committee also considered whether the provision of non-audit services to our Company by Deloitte was compatible with maintaining their independence. Based on the review and discussions referred to above, the Audit Committee recommended to the Board Independence.”of Directors that the audited financial statements referred to above be included in our Annual Report on Form 10-K for the year ended December 31, 2023, for filing with the SEC. Respectfully submitted by the Audit Committee of the Board of Directors. Carin M. Barth (Chair)

Stephen D. Quinn

Steven P. Stanbrook

Charles L. Szews

Anne Taylor GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 78 Proposal 3:

Appoint Deloitte & Touche LLP

to Serve as Independent Auditor

for 2024What

am I

voting on? | We are asking shareholders to ratify the appointment of a firm of independent registered public accountants to serve as the Company’s independent auditor for the fiscal year ending December 31, 2024. Deloitte & Touche LLP, an independent registered public accounting firm, has served as Group 1’s independent auditor since 2020. For 2024, the Audit Committee has reappointed Deloitte as our independent auditor, and the Board has approved the firm for appointment by the shareholders. |

Frequently Asked Questions About the AuditorHOW IS THE AUDITOR RETAINED AND REVIEWED BY THE COMPANY? The Audit Committee is directly responsible for the nomination, compensation, retention and oversight of the Company’s independent auditor. To fulfill this responsibility, the Audit Committee engages in an annual evaluation of the independent auditor’s qualifications, performance and independence, and periodically considers the advisability of selecting a different independent registered public accounting firm to serve in that capacity. HOW LONG MAY THE AUDIT PARTNER PROVIDE SERVICES TO GP1? In accordance with SEC rules and Deloitte’s policies, audit partners are subject to rotation requirements that limit the number of consecutive years an individual partner may provide service to Group 1. For lead and concurring audit partners, the limit is five years. The selection process for the lead audit partner includes meetings between the members of the Audit Committee and the candidate, as well as consideration of the candidate by the full Audit Committee with input from management. WILL THE AUDITOR ATTEND THE ANNUAL MEETING? Representatives of Deloitte will be present during the 2024 Annual Meeting and will have the opportunity to make a statement and respond to appropriate questions from shareholders. GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 79 WHAT WERE THE AUDITOR’S FEES IN 2023 AND 2022? | Type of Fees | | 2023 | | | 2022 | | | Audit Fees | | $ | 3,110,000 | | | $ | 2,686,300 | | | Audit-Related Fees | | | — | | | | — | | | Tax Fees | | | 40,000 | | | | 34,350 | | | All Other Fees | | | — | | | | — | | | TOTAL | | $ | 3,150,000 | | | $ | 2,720,650 | |

Audit Fees Audit fees consisted of amounts accrued for services performed in association with the integrated audit of the Company’s consolidated financial statements for 2022 and 2023, and attestation of the effectiveness of the Company’s internal controls over financial reporting (including required quarterly reviews). Other procedures included consultations on audit or accounting matters that arise during or as a result of the audit or quarterly reviews. Audit fees for 2022 and 2023 also include fees related to acquisition and divestiture activity during the year. Also included in audit fees are amounts accrued for assurance services related to statutory audits. Audit fees exclude reimbursed expenses of $100,000 and $135,000 for 2022 and 2023, respectively, in conjunction with Deloitte's services. Audit-Related Fees Audit-related fees in both years include amounts for services that are related to the performance of the audit or review of our financial statements, consisting primarily of services performed in connection with SEC registration statements, periodic reports and other documents filed with the SEC or documents issued in connection with securities offerings. There were no audit-related fees in 2022 or 2023. Tax Fees Tax fees in 2023 and 2022 related to tax compliance services. All Other Fees There were no other fees in 2022 or 2023. HOW DOES THE AUDIT COMMITTEE MONITOR AND CONTROL NON-AUDIT SERVICES? The Audit Committee has established procedures requiring its review and advance approval of all engagements for non-audit services provided by Deloitte. The Audit Committee Chair has the delegated authority to pre-approve permitted non-audit services with certain limitations and must notify the Audit Committee at its next meeting of each service so approved. The Audit Committee approved all of Deloitte’s engagements and fees for 2023 and 2022. The Audit Committee reviews with Deloitte whether non-audit services to be provided are compatible with maintaining the firm’s independence. In addition, the Audit Committee monitors the fees paid to Deloitte so that fees paid in any year to Deloitte for non-audit services do not exceed the fees paid for audit and audit-related services. Non-audit services consist of those described above, as tax compliance fees. WHY SHOULD I VOTE FOR THIS PROPOSAL? Through its review process, the Audit Committee determined that Deloitte has acquired extensive knowledge of the Company’s operations, performance and development through its previous service as the independent auditor for Deloitte. The Audit Committee and the Board believe that the continued retention of Deloitte as our independent auditor is in the best interest of the Company and our shareholders.  | | | | | THE BOARD UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE FOR RATIFICATION OFTHE APPOINTMENT OF DELOITTE & TOUCHE LLP AS OUR INDEPENDENT REGISTERED PUBLICACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2024. |

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 80Proposal 4:

Approve 2024 Employee

Stock Purchase Plan

What

am I

voting on? | The Board unanimously recommends that shareholders approve the second amended and restated Employee Stock Purchase Plan to increase the number of shares available for issuance under the plan and to extend the term to May 24, 2034. |

Why Should I Vote For This Proposal?Security Ownership InformationBACKGROUND AND PURPOSE OF THE PROPOSAL

Our Board and our shareholders originally adopted the Group 1 Automotive, Inc. Employee Stock Purchase Plan (the “Plan”) on September 23, 1997. The purpose of the Plan is to provide an incentive for our employees to acquire an interest in our Company through their purchase of shares of our common stock. Amendments to the Plan increasing the number of shares issuable under the Plan were approved by the Company and our shareholders in 1998, 2000, 2003, 2006, 2009 and 2015. The most recent version of the Plan adopted in 2015 provided that an aggregate of 4,500,000 shares could be issued under the Plan. On March 27, 2024, our Board adopted the second amendment and restatement of the Plan (the “Amended Plan”), to be effective as of May 15, 2024, to (a) increase the number of shares of common stock available for issuance under the Plan from 4,500,000 to 4,750,000 shares (the “Share Increase”), (b) extend the term of the Plan from May 19, 2025, to March 24, 2034 (the “Term Extension”) and (c) remove the 180-day sale restriction following the exercise of an option (the “Resale Restriction”). The Share Increase and the Term Extension amendments are the only two items within the Amended Plan that require shareholder approval to become effective. Because the Resale Restriction described in clause (c) above is not a material amendment to the Plan it will become effective regardless of the outcome of the vote on this Proposal 4. The material terms of the Amended Plan are summarized below. In the event that the additional shares are approved for issuance pursuant to the Plan, the Company will promptly register the additional shares with the SEC on a registration statement on Form S-8. CONSEQUENCES OF FAILING TO APPROVE THE PROPOSAL The Amended Plan will not be implemented unless it is approved by shareholders. If the Amended Plan is not approved by our shareholders, the Plan will remain in effect in its present form and eligible participants will only be able to purchase the remaining approved shares under the Plan. As of December 31, 2023, 270,833 shares remained available for purchase pursuant to the Plan, which, based on current participation levels and a stock price of $304.74 as of December 29, 2023 (the last trading day of 2023), we expect to be depleted prior to the end of the term of the Plan. Failure of our shareholders to approve this Proposal 4 will not affect the rights of existing participants under the Plan or under any previously granted awards under the Plan. GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 81 SECURITY OWNERSHIPSUMMARY OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENTAMENDED PLAN

The following summary provides a description of the Plan assuming that the proposed second amendment and restatement of the Plan is approved and becomes effective. The following summary of the Amended Plan is qualified in its entirety by reference to the complete text of the Amended Plan, that has been filed with the Securities and Exchange Commission as Appendix A to this filing. Shares Available under the Plan; Adjustments The total number of shares of common stock that may be issued under the Amended Plan may not, in the aggregate, exceed 4,750,000 shares (including all shares previously sold under the Plan prior to the effective date of this second amendment and restatement), which may be unissued or reacquired shares, including shares bought on the market or otherwise for purposes of the Amended Plan. As of December 31, 2023, 4,299,166.61 shares had been issued under the Plan. The number of shares issuable under the Amended Plan is subject to adjustment in the event of a change in our common stock by reason of a stock dividend or by reason of a subdivision, stock split, reverse stock split, recapitalization, reorganization, combination, reclassification of shares or other similar change. Upon any such event, the maximum number of shares that may be subject to any option, and the number and option price of shares subject to options outstanding under the Amended Plan will also be adjusted accordingly. Eligibility Each of our employees or the employees of any “Participating Company” as of a grant date is eligible to participate in the Amended Plan. Each of our present or future parents or subsidiaries that is located within the United States or the United Kingdom is automatically designated as a Participating Company unless the administrative committee of the Amended Plan (the “Administrative Committee”) makes a written determination to the contrary. However, no option may be granted to an employee if such employee, immediately after the option is granted, owns 5% or more of the total combined voting power or value of all classes of our stock. As of December 31, 2023, approximately 16,019 employees were eligible to participate in the Plan. Participation An eligible employee may elect to participate in the Amended Plan for any calendar quarter during the period from March 24, 2024, to March 24, 2034, on the first day of each successive April, July, October and January (each of which dates is referred to as a “date of grant”). Except as otherwise provided in the Amended Plan, the term of each option granted under the Amended Plan will be for three months (each of such three-month periods is referred to as an “option period”), which will begin on a date of grant and end on the last day of each option period (referred to as a “date of exercise”). Subject to certain limitations of the Internal Revenue Code of 1986, as amended (the “Code”), the number of shares subject to an option for a participant will equal the quotient of (a) the aggregate payroll deductions withheld on behalf of such participant during the option period, divided by (b) the option price of our common stock applicable to the option period, including fractions. However, the maximum number of shares that may be subject to any option may not exceed 3,000 (subject to adjustment). An eligible employee may participate in the Amended Plan only by means of payroll deduction. Each eligible employee who elects to participate in the Amended Plan must deliver to our company, within the time period prescribed by the Administrative Committee, a written payroll deduction authorization form whereby he or she gives notice of his or her election to participate in the Amended Plan as of the next following date of grant, and whereby he or she designates a whole percentage of his or her eligible compensation to be deducted from his or her compensation for each pay period and paid into the Amended Plan for his or her account. The designated percentage may not be less than 1% or greater than 10%. However, no employee may be granted an option under the Amended Plan that permits such employee to purchase more than $25,000 of our common stock (based on its fair market value at the time such option is granted) in any calendar year. Subject to the limits described above, each participant in the Amended Plan automatically and without any act on his or her part will be deemed to have exercised his or her option on each date of exercise to the extent of his or her unused payroll deductions under the Amended Plan and to the extent the issuance of our common stock to such participant upon such exercise is lawful. The per share purchase price of the common stock to be paid by each GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 82 participant on each exercise of his or her option will equal 85% of the fair market value of our common stock on the date of exercise or on the date of grant, whichever amount is less. For all purposes under the Amended Plan, the fair market value of a share of our common stock on a particular date is equal to the closing price of our common stock on the New York Stock Exchange on that date (or, if no shares of common stock have been traded on that date, on the next regular business date on which shares of the common stock are so traded). As of December 29, 2023, the fair market value of a share of our common stock was $304.74. A participant who elects to participate in the Amended Plan and who takes no action to change or revoke the election prior to any subsequent date of grant will be deemed to have made the same election, including the same attendant payroll deduction authorization, for the next following and/or subsequent date(s) of grant. Withdrawal from the Plan and Changes in Payroll Authorization A participant may not elect to change the percentage of his or her payroll deductions during an option period. However, any participant may withdraw in whole, or in part, from the Amended Plan on or before the fifteenth day of the last month of a particular option period by timely delivering a notice of withdrawal. Partial withdrawals are not permitted. Promptly following receipt of the notice of withdrawal, we will refund to the participant the amount of his or her payroll deductions under the Amended Plan that have not yet been otherwise returned or used upon exercise of options and the participant's payroll deduction authorization and interest in unexercised options under the Amended Plan will terminate. Delivery of Shares; Restrictions on Transfer As soon as practicable after each date of exercise, we will deliver to a custodian selected by the Administrative Committee one or more certificates representing (or will otherwise cause to be credited to the account of such custodian) the total number of whole shares of our common stock respecting options exercised on such date of exercise in the aggregate (for both whole and fractional shares) of all of the participating eligible employees. The custodian will keep accurate records of the beneficial interests of each participating employee in such shares by means of participant accounts under the Amended Plan, and will provide quarterly or such other periodic statements with respect thereto as may be directed by the Administrative Committee. The Administrative Committee may, from time to time, specific with respect to a particular grant of options, establish a restriction period that shall apply to the shares of common stock acquired pursuant to such options. Following this restriction period, the optionee may, in accordance with procedures established by the Administrative Committee and the custodian, direct the sale or distribution of some or all of the whole shares of common stock in his or her account that are not then subject to transfer restrictions and, in the event of a sale, request payment of the net proceeds from such sale. The transfer restrictions will continue to apply upon a participant's termination of employment. Termination of Employment; Leaves of Absence Except as described below, if the employment of a participant terminates for any reason, then the participant's participation in the Amended Plan automatically ceases and we will refund the amount of such participant's payroll deductions under the Amended Plan that have not yet been otherwise returned or used upon exercise of options. During a paid leave of absence approved by us and meeting Internal Revenue Service regulations, a participant's elected payroll deductions will continue. A participant may not contribute to the Amended Plan during an unpaid leave of absence. If a participant takes an unpaid leave of absence that is approved by us and meets Internal Revenue Service regulations, then such participant's payroll deductions for such option period that were made prior to such leave may remain in the Amended Plan and be used to purchase common stock on the date of exercise relating to such option period. If a participant takes a leave of absence that is not described in the first or third sentence of this paragraph, then such participant will be considered to have withdrawn from the Amended Plan. Further, notwithstanding the foregoing, if a participant takes a leave of absence that is described in the first or third sentence of this paragraph and such leave of absence exceeds three months, then such participant will be considered to have withdrawn from the Amended Plan on the first day after such three-month period (unless such participant has a right to reemployment guaranteed either by statute or contract, in which case such participant will not be considered to have withdrawn from the Amended Plan unless and until he fails to return to employment on the first day following the period during which his reemployment rights are so guaranteed). GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 83 Restriction upon Assignment of Option An option granted under the Amended Plan may not be transferred other than by will or the laws of descent and distribution. Subject to certain limited exceptions, each option is exercisable, during the employee's lifetime, only by the employee to whom it was granted. Administration and Modification of the Plan The Amended Plan is administered by the Administrative Committee, the members of which are appointed from time to time by our Board. Our Board, in its discretion, may terminate the Amended Plan at any time with respect to any common stock for which options have not been granted. However, no change in any option granted may be made that would impair the rights of an optionee without the consent of such optionee. Our Board or the Administrative Committee has the right to alter or amend the Amended Plan or any part thereof from time to time; provided that shareholder approval is also required to (1) increase the aggregate number of shares which may be issued pursuant to the Amended Plan (other than as a result of the anti-dilution provisions), (2) change the class of corporations whose employees may receive options under the Amended Plan or the class of eligible employees, (3) extend the term of the Amended Plan or (4) otherwise cause options issued under the Amended Plan to fail to meet the requirements of employee stock purchase options as defined in Section 423 of the Code. Merger, Consolidation or Liquidation of Group 1 If our Company is not the surviving corporation in any merger or consolidation (or survives only as a subsidiary of another entity), or if Group 1 is to be dissolved or liquidated, then, unless a surviving corporation assumes or substitutes new options (within the meaning of Section 424(a) of the Code) for all options then outstanding, (a) the date of exercise for all options then outstanding will be accelerated to a date fixed by the Administrative Committee prior to the effective date of such merger or consolidation or such dissolution or liquidation and (b) upon such effective date any unexercised options will expire and we promptly will refund to each participant the amount of such participant's payroll deductions under the Amended Plan that have not yet been otherwise returned to him or her or used upon exercise of options. Plan Benefits Non-employee directors are not eligible to participate in the Amended Plan. The benefits to be received by our executive officers and employees as a result of the proposed amendment and restatement of the Plan are not determinable because the amounts of future purchases by participants are based on elective participant contributions. UNITED STATES FEDERAL INCOME TAX CONSEQUENCES The following is a brief summary of certain of the United States federal income tax consequences relating to the Amended Plan based on federal income tax laws currently in effect. This summary applies to the Amended Plan as normally operated and is not intended to provide or supplement tax advice to eligible employees. The summary contains general statements based on current United States federal income tax statutes, regulations and currently available interpretations thereof. This summary is not intended to be exhaustive and does not describe state, local or foreign tax consequences or the effect, if any, of gift, estate and inheritance taxes. The Amended Plan is not qualified under Section 401(a) of the Code. The Amended Plan is intended to be an “employee stock purchase plan” within the meaning of Section 423 of the Code. Under this type of plan, no taxable income will be reportable by a participant, and no deductions will be allowable to us, due to the grant of the option at the beginning of an offering or at the purchase of shares at the end of an offering. A participant will, however, recognize taxable income in the year in which the shares purchased under the Amended Plan are sold or otherwise made the subject of disposition. A sale or other disposition of shares purchased under the Amended Plan will be a “disqualifying disposition” if such sale or disposition occurs prior to the later of (i) two years after the date the option is granted (i.e., the commencement date of the offering period to which the option pertains) and (ii) one year from the date of the purchase of the applicable shares. If the participant makes a disqualifying disposition of shares purchased under the Amended Plan, the excess of the fair market value of the shares on the date of purchase over the purchase price will be treated as ordinary income to the participant at the time of such disposition, and any additional gain (or loss) on the disposition (after adding GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 84 the amount treated as ordinary income to the participant's basis in the shares) will be a capital gain (or loss) to the participant. We will be entitled to an income tax deduction for the amount treated as ordinary income to the participant for our taxable year in which the disposition occurs, although the income tax deduction may be limited by the deductibility of compensation paid to certain of our officers under Section 162(m) of the Code. In no other instance will we be allowed a deduction with respect to the participant's disposition of the purchased shares. If the participant sells or otherwise disposes of shares purchased under the Amended Plan after satisfying the holding period outlined above (i.e., a qualifying disposition), then the participant will realize ordinary income in the year of disposition equal to the excess of the lesser of (i) the fair market value of the shares on the date of disposition over the purchase price for the shares or (ii) the greater of (a) the fair market value of the shares on the date the option relating to the disposed shares was first granted over the purchase price and (b) the fair market value of the shares on the day immediately prior to the consummation of the transaction over the purchase price. Any additional gain (or loss) on the disposition (after adding the amount treated as ordinary income to the participant's basis in the shares) will be long-term capital gain (or loss) to the participant. We will not be entitled to an income tax deduction for any amount with respect to the issuance or exercise of the option or the sale of the underlying shares. VOTE REQUIRED Approval of the Amended Plan requires the affirmative vote of the holders of a majority of the shares of common stock present in person or by proxy and entitled to vote on the matter. Abstentions shall be deemed a vote against this Proposal 4. However, broker non-votes will not be counted as shares entitled to vote, and thus will not be considered for purposes of determining whether a majority has been achieved. If you own shares through a bank, broker or other holder of record, you must instruct your bank, broker or other holder of record how to vote your shares in order for your vote to be counted with respect to this Proposal 4. Participation by Certain Individuals As discussed above, all employees of the Company, including employees who are directors and executive officers who meet designated eligibility criteria, are eligible to purchase common stock under the Amended Plan. The following table sets forth participation in the Plan by the certain individuals and groups listed below for the 12 months ended December 31, 2023(1): | Name and Position | | Dollar Value of Discount ($) | | Number of Shares of Common Stock

Purchased (#) | Daryl A. Kenningham

(Chief Executive Officer and President) | | 3,750.00 | | 139.54 | Daniel J. McHenry

(Senior Vice President & Chief Financial Officer) | | 3,750.00 | | 139.54 | Gillian A. Hobson

(Senior Vice President, Chief Legal Officer & Corporate Secretary) | | 0.00 | | 0.00 | Peter C. DeLongchamps

(Senior Vice President) | | 2,132.80 | | 76.39 | Michael D. Jones

(Senior Vice President) | | 3,750.00 | | 135.59 | | Executive Officer Group | | 14,662.75 | | 526.61 | | Non-Employee Director Group | | 0.00 | | 0.00 | | Non-Executive Officer Employee Group | | 3,562,392.33 | | 119,381.89 |

| (1) | As discussed above, all employees of the Company, including employees who are directors and executive officers who meet designated eligibility criteria, are eligible to purchase common stock under the Amended Plan. For illustrative purposes, the following table sets forth participation in the Plan by certain individual and groups listed below for the 12 months ending December 31, 2023. This reflects stock purchased in 2023 with respect to the following four quarterly offering periods: (i) October 1, 2022 to December 31, 2022 (stock purchased in January 2023); (ii) January 1, 2023 to March 31, 2023 (stock purchased in April 2023); (iii) April 1, 2023 to June 30, 2023 (stock purchased in July 2023) and (iv) July 1, 2023 to September 30, 2023 (stock purchased in October 2023). |

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 85 SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLAN The following table shows the amountsummarizes information about each of our common stock beneficially owned (unless otherwise indicated)equity compensation plans, including the LTIP and the Plan, as of December 31, 2023: | Plan Category | | (a)

Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights | | (b)

Weighted average

exercise price of

outstanding options,

warrants and rights | | (c)

Number of securities